Weekly Market Commentary – 2/17/2023

-Darren Leavitt, CFA

US equity markets finished the week mixed, as economic data reported during the week indicated that inflation remains elevated. Fed rhetoric was prevalent and had a more hawkish tilt. Cleveland Fed President Loretta Mester suggested that she was in favor of a 50-basis point hike in the most recent FOMC meeting and put a 50-basis point on the table for March. The hotter inflation data and the strong January Employment Situation Report have also increased the likelihood of a third interest rate hike at the June meeting. The bond market took note and sold off across the curve for the second consecutive week.

Currently, there appears to be a disconnect between the equity and bond markets. Bonds have had a meaningful selloff on the most recent data, while equities have all but shrugged off the stronger-than-anticipated economic data. This comes as equity valuation metrics have soared while earnings estimates are seemingly too high and poised to be cut. Also of note, is the significant divergence between growth and value performance within equities. Last year’s losers appear to be thus far this year’s winners and vice versa. Institutional rebalancing and a profound January effect may well be the reason for the divergence.

For the week, the S&P 500 lost 0.3%, the Dow shed 0.1%, the NASDAQ gained 0.6%, and the Russell 2000 rose 1.4%. The US Treasury yield curve had another shift higher as all tenors sold off. The 2-year note yield increased by ten basis points to 4.61% but traded as high as 4.71%. The 2-year yield has risen by thirty-two basis points over the last two weeks. The 10-year yield increased by nine basis points to 3.83% and is up thirty basis points over the previous two weeks. Oil prices tumbled 3.7% or $2.91 to $76.57 a barrel. Gold prices fell $22.60 to close at $1851.30 an Oz. Copper prices advanced by $.09 or 2.2 percent, closing at $4.11 an lb.

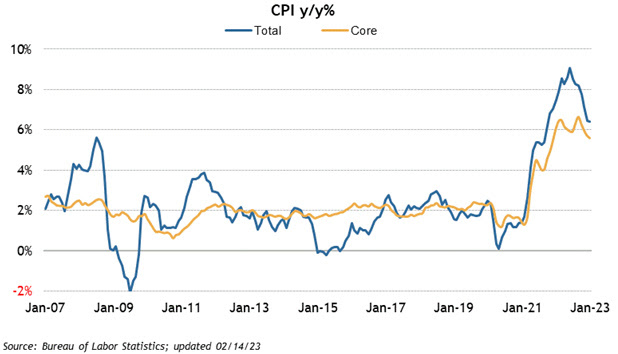

The economic data calendar was stacked this week. The Consumer Price Index came in line on the headline and core numbers at 0.5% and 0.4%, respectively. On a year-over-year basis, consumer prices continued to be robust, up 6.4% on the headline and up 5.6% on the core reading that excludes food and energy. Shelter costs continued to be strong, an area the Fed has voiced concern over. The Producer Price Index was hotter than expected on the headline and core numbers, coming in at 0.7% and 0.5%, respectively. Retail Sales showed a robust consumer in January. Retail sales increased by 3% versus the consensus estimate of 1.7%. The labor market continues to show no signs of weakness as Initial Claims data for the week showed another sub 200k reading while Continuing Claims came in at 1.696k. Finally, January Industrial production came in a bit light at 0% versus the estimate of 0.5%.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.